Merlin Sales Fetcher: Streamlining Reconciliation and Import Processes

Merlin Sales Fetcher is an advanced integration tool designed to facilitate the direct import of sales reports from Merlin FTP into eddy.app. This tool simplifies the process by eliminating the need for manual uploads. Users can effortlessly upload their Merlin remittance PDFs for each period, enabling the system to automate the reconciliation of sales reports with invoices.

- Upgrade your plan: switch to the Record Company plan.

- Collect Remittance advices: Each month, gather your remittance advice PDFs, received via email.

- FTP Credentials: Retrieve these from the Merlin Wizard. Go to Settings > Company settings > Integrations to input your Merlin FTP credentials.

- Admin fee: Configure this once in the Royalty Sources section to ensure accurate fee calculations.

Import Process: A Step-by-Step Guide

Efficiently create a Merlin Fetch by uploading your monthly remittance advice PDFs in various currencies (EUR, GBP, USD). Our system will identify and reconcile the relevant reports for the period with your invoices.

1. Create a Merlin Fetch

- Upload your monthly remittance advice PDFs for each currency (EUR, GBP, USD).

- Navigate to Sales > Merlin Fetcher, select the reporting period, upload your PDFs, input exchange rates, and click 'Create'.

- The system will automatically identify relevant reports for the period and reconcile them with your invoices.

2. Reconciliation:

- eddy.app fetches and matches invoices with sales reports from Merlin FTP.

- Review the fetch summary and detailed list, including descriptions, amounts, statuses, and actions.

3. Triggering Imports:

- After reconciliation, initiate imports for reconciled items.

- Set items not to be imported on hold.

- Begin with Spotify, Deezer, and Apple Music reports to minimize errors, then use the bulk actions "trigger all".

4. Final Check and Completion:

- Ensure the total sales import value matches the revenue received from Merlin.

- Mark the fetch as complete when all figures align.

- Complete Fetches: Include all remittance advice PDFs from the same period in a single fetch.

- Accurate Exchange Rates: Match the rates with those provided by your bank.

- Period Mismatches: Verify the reporting periods on your remittance advice to avoid discrepancies.

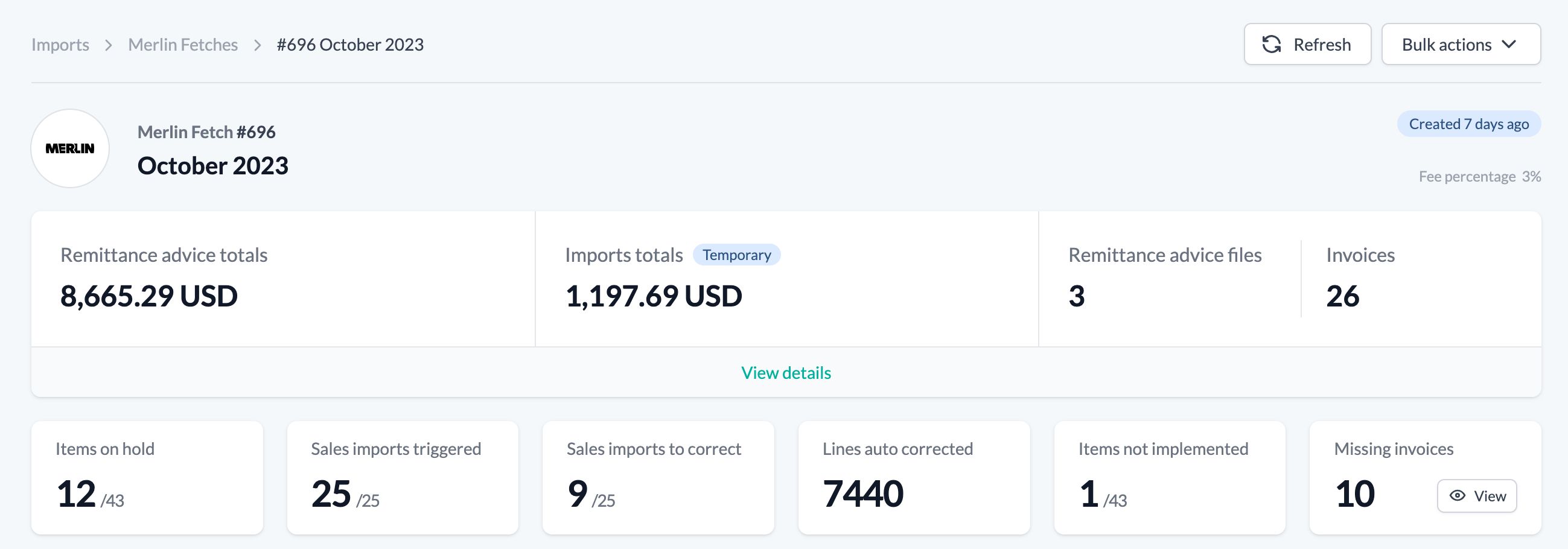

Fetch Summary: A Closer Look

This section provides detailed insights into the Merlin Fetch process. Once all invoices are reconciled, initiate the import process, either in bulk or individually. Confirm that the total amount in your remittance advice matches your total imports to verify transaction accuracy.

- Items on hold: These items are excluded from the total remittance advice value.

- Sales imports triggered: Number of sales reports successfully integrated into your database.

- Sales import to correct: Highlights the number of reports with discrepancies that need resolving.

- Auto-Corrected Lines Total lines eddy.app has automatically corrected.

- Items not implemented: Identifies invoices that were not recognized by the system.

- Missing invoices: Alerts to any invoices not found on the Merlin FTP server.

Fetch Items List: Detailed Status

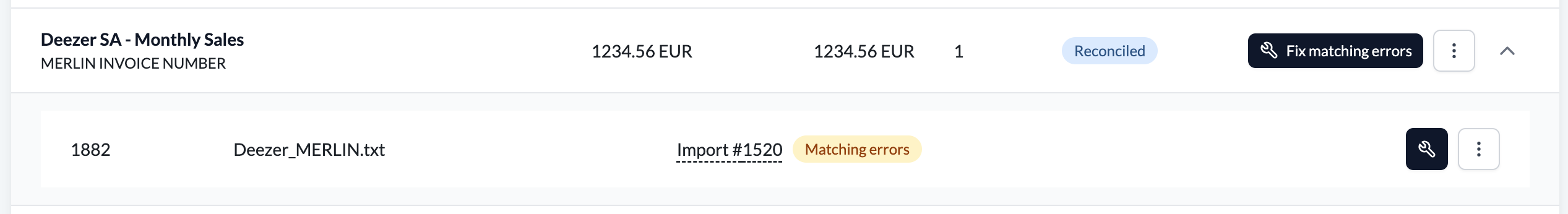

This section categorizes each invoice and report within a Merlin fetch by its current status, including 'Reconciling', 'Reconciled', 'Amount Mismatch', 'Manual Fetch', and 'Reconciliation Error'. For more information and suggested next steps, click on the dropdown icon next to each status.

- Reconciling: The system is actively aligning invoices with reports. Please wait during this process.

- Reconciled:: Invoices and sales reports have been successfully matched. Discrepancies below 0.01 $/€/£ are deemed negligible and do not impact the overall reconciliation.

- Amount Mismatch:: This status indicates a significant difference (over 1%) between the invoice amount and the report amount, necessitating further review.

- Manual fetch: This is used when an import is manually linked to an invoice, typically for items lacking a report or presenting specific issues.

- reconciliation error: Indicates a minor issue in the reconciliation process. You can still proceed with importing the relevant report, but ensure the total import value aligns with the invoice value.

Action Required: Hanlding Challenges

This part provides a clear guide on the actions to take based on the status of each item in your Merlin fetch.

- Missing invoices:: These are invoices not found on the FTP server. If you encounter this, you need to investigate why they're missing with Merlin directly.

- Not implemented: Encounter an unrecognized DSP invoice? Reach out to our support team for assistance.

- No Report: For DSP were you're not expecting a report, use the Breakage Revenue tool. Alternatively, our support team is here to help.

- Sales report not found: : If a report is missing, check if it's avaialbel in the Merlin wizard and set the item on hold if necessary.

- Refetch needed: Initiate a refetch from the bulk action menu.

- Correct Matching Errors: Click 'Fix matching errors' to correct matching issues.

- Errors: Hover over for explanations; often due to unexpected reporting format changes.

- Prioritizing Reports: Start with Spotify, Deezer, and Apple Music reports to reduce matching errors.

- Breakage Revenue Tool: An essential feature for handling 'No Reports' scenarios.

- Handling 'Sales Reports Not Found': Learn how to set relevant items on hold to maintain accuracy.

Linking imports with manual fetches

In instances where Merlin doesn't supply a report, you have the flexibility to craft one yourself using the Breakage Revenue tool. This process involves a few key steps:

- Use the Link Function: This allows you to manually connect the created report to the corresponding invoice.

- Match the Currency: Ensure that the currency in your manually created import file aligns with that of the template. If dealing with a different currency, specify the exchange rate – the same one used during the fetch creation.

- Typical Use Cases: This method is particularly useful for platforms like Meta and YouTube, where you might encounter 'no report invoices'.

For a detailed guide on creating your own breakage revenue report, don't forget to check out our dedicated article on this topic. It's packed with helpful tips and step-by-step instructions to streamline this process.