This article will give you a detailed breakdown of a statement to help you understand and interpret each line and its corresponding amount.

Statement Breakdown

Book Page and Letter

The first two pages of the statement PDF are customizable to suit your company's visual identity. Add your logo to the Book Page, and change the Letter copy if you need to share specific information with your payees.

-

The Book Page

-

The Letter

Head to your Settings to personalize the Book Page and Letter.

All statement personalization settings are centralized in this article

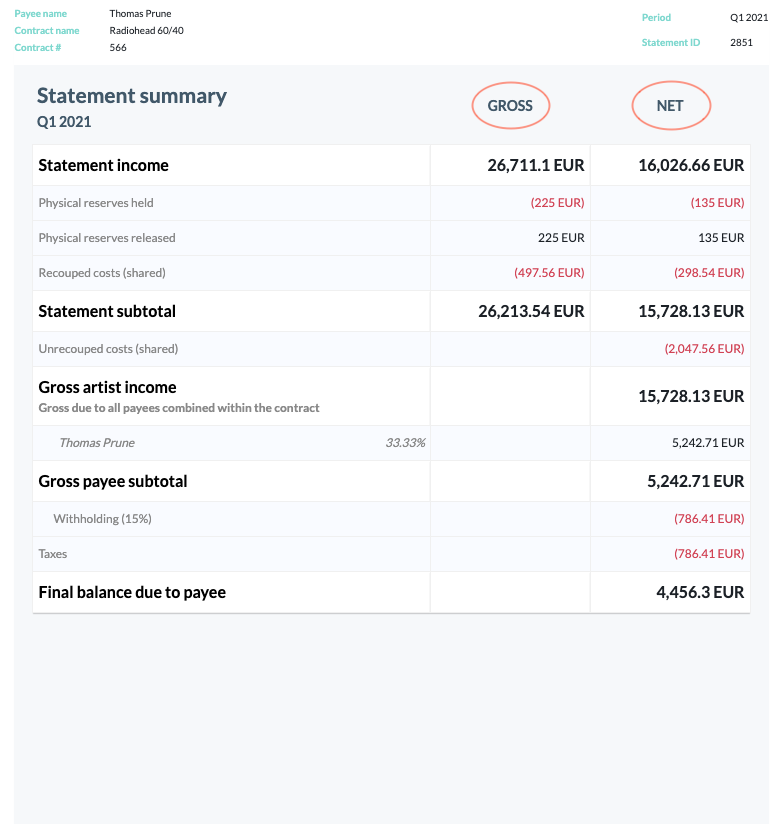

Statement Summary

The Statement Summary is the heart of the statement. It is where income for the period is displayed, along with recoupable costs and advances, cross-contract deductions, tax deductions, etc.

By default, the Statement Summary is split into two columns:

- The GROSS column reflects the total income for the period, both your and your payee(s)' shares.

- The NET column reflects the payee's income share for the period, i.e. the total income after their royalty rate has been applied.

You can choose whether to display both columns or only the NET column on statements. Refer to this article for instructions.

Line-by-line Breakdown

Below, you'll find a detailed breakdown of each statement line.

-

Statement Income

This is the total income for the period, prior to any recoupment or deduction being applied.- The deductions applied at this level are as follows:

- Physical reserves

- Cross-contract deductions: you can find more details about these here

- Shared cost recoupment

- The deductions applied at this level are as follows:

-

Statement Subtotal

This is the statement amount after applying physical reserves (held and released), cross-contract deductions and shared cost recoupment.- The pending balances at this level are as folllows:

- Unrecouped shared costs

- The pending balances at this level are as folllows:

-

Gross Artist Income

This is the gross amount due to all payees within the contract. Each payee will see only their own split %, as configured in their contract. -

Gross Payee Subtotal

This is the gross amount due to the individual payee associated with this statement.- Deductions applied at this level are as follows:

- Artist cost recoupment

- Deductions applied at this level are as follows:

-

Gross Payee Amount

This is the gross amount due to the payee after artist cost recoupment.- Pending balances at this level are as follows:

- Taxes

- Unrecouped artist costs

- Pending balances at this level are as follows:

-

Net Payee Subtotal

This is the net amount due to the payee, prior to applying carryovers and/or advance recoupment.- Deductions applied at this level are as follows:

- Advances

- Negative carryovers

- Deductions applied at this level are as follows:

-

Net Payee Income

This is the net amount due to the payee after carryover and advance recoupment. -

Pending balances at this level are as follows:

- Unrecouped advances

-

Final Balance Due to Payee

This is the final balance due to the payee. If there are remaining unrecouped costs or advances associated with the contract or payee, the final balance will be displayed in red as it is a negative amount.

Unrecouped balances (i.e. negative balances) are carried forward to the next statement until they are fully recouped.